3i Group – Ready? Action!

An investment case on 3i Group and its crown jewel, Action.

Price: 3273 GBp

P/NAV: 1.14

NAV/Share CAGR: 19.8% (2012-2025)

Shares outstanding: ~988m

Market cap: ~32.1B GBP

Ticker: III.L

3i Group - Ready? Action!

If you want a single sentence for what 3i is today, it is this:

3i is increasingly a public wrapper around Europe’s most exceptional retailer.

That retailer is Action. And Action is doing most of the heavy lifting.

Over the last few years, the market has slowly woken up to that reality. 3i’s NAV per share has compounded strongly, Action has expanded across Europe at speed, and yet the share price can still swing hard on relatively small changes in sentiment.

That is exactly the setup investors should lean into:

A business with genuinely elite unit economics (Action),

held inside a structure that sometimes trades like a “messy” investment company,

with a valuation that can move on top of fundamentals.

This article is the case for why Action is a structural winner, why 3i is the way to own it, and how to think about the risks and the valuation without making bold assumptions.

3i Group

3i is a London-listed investment company with private equity and infrastructure roots. In practice, however, it has evolved into a concentrated, long-term owner of a small number of assets, with Action as the clear dominant driver.

This is not a typical “hardcore” private equity model. Traditional PE firms buy businesses, cut costs, apply leverage, and exit. With Action, 3i has done the opposite: it has bought an exceptional business and allowed it to compound over time.

Importantly, 3i continues to value Action conservatively, at roughly 18.5x EBITDA, while steadily increasing its ownership stake. This patient, buy-and-hold approach is not a weakness of the story. It is central to the investment thesis.

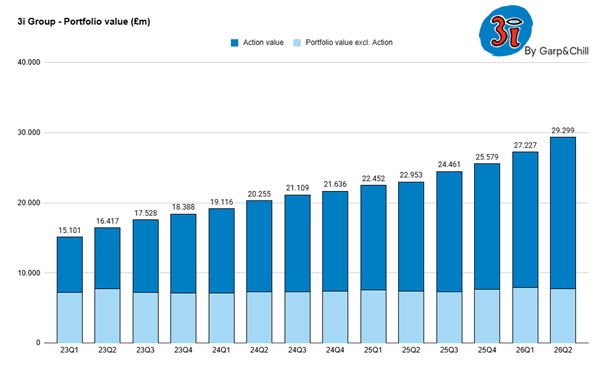

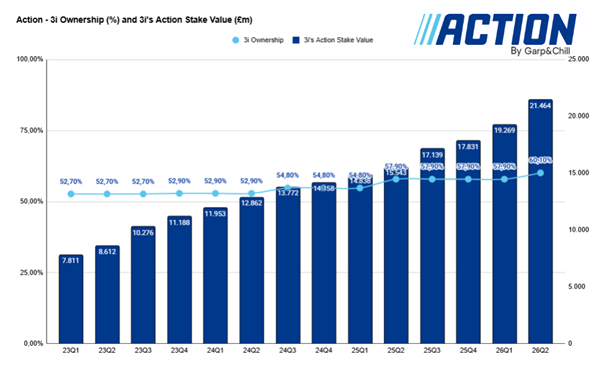

Two charts make that point better than any paragraph:

Portfolio composition: total portfolio value rises steadily, but the “ex Action” portion is comparatively stable while Action expands.

Action stake value + ownership: 3i’s ownership moves from ~52-53% to 60.1%, while the value of the stake rises from £7.8bn (23Q1) to £21.5bn (26Q2). At day of writing, 3i even increased its stake to now own 62.3% of Action.

This is the key framing for the whole thesis:

Treat 3i as “Action plus the rest at reported values.”

Action does the lifting. Everything else is additional upside and diversification.

That framing is also conservative for one simple reason: historically, 3i Group tends to exit at premiums to conservative reported net carrying values. You do not need to bake that in. Just treat the remainder as “real at NAV” and focus on Action.

You might ask yourself the question why you shouldn’t just buy Action directly. Because you cannot. Action is private. 3i is the liquid access point.

And 3i has been increasing its exposure by recently increasing its stake to 62.3% and its stake value well over £23bn.

That is not the action of a cautious owner trying to de-risk concentration. It is the action of a rational capital allocator leaning into its best asset.

The Simon Borrows story

A large part of 3i’s re-rating over the past decade is inseparable from one management decision: a fundamental change in what kind of company 3i wanted to be.

Simon Borrows joined 3i in October 2011 as Chief Investment Officer and Executive Director, and later became CEO. His impact went far beyond portfolio construction. He re-architected the entire business model.

Historically, 3i operated much like a traditional private equity platform: raising third-party capital, managing funds, and earning fees. Under Borrows, that model was deliberately dismantled. 3i stopped fundraising altogether and chose to invest exclusively off its own balance sheet.

This shift is crucial. The firm moved:

from gathering assets to compounding capital,

from fee maximization to return maximization,

from short-duration exits to long-term ownership.

Under Borrows’ leadership, 3i’s strategy became far more focused: fewer holdings, longer holding periods, and a willingness to let a truly exceptional compounding asset dominate capital allocation.

That matters because concentrated structures only work if:

management is rational about capital allocation,

governance is shareholder-aligned,

and incentives do not encourage “activity for activity’s sake.”

By eliminating third-party fundraising, those incentives were structurally realigned. Management now lives or dies by the same NAV per share growth as shareholders.

Insider alignment, therefore, is not a footnote to the story. It is part of the thesis. Most notably, on November 14, 2025, Simon Borrows purchased 30,000 shares of 3i Group, adding to his personal exposure following a period of share price weakness. Borrows committed another £1.0m of personal capital. This reinforces that capital allocation discipline and long-term ownership are not just rhetoric, but practice.

Insider ownership and recent transactions

Insider alignment at 3i extends well beyond the CEO. It is visible across both the executive team and the board, and has been reinforced through meaningful open-market purchases, particularly during periods of share price weakness.

At the center sits Simon Borrows, who owns approximately 1.77% of the company, equivalent to £560m+ at recent prices. That level of ownership is highly unusual for a FTSE-listed investment company and ensures capital allocation decisions are made with a true owner’s mindset.

Borrows’ purchase was not isolated. In the surrounding weeks, several senior executives and board members, including the CFO, COO, General Counsel, and multiple non-executive directors, also bought shares on the open market at prices between £30 and £34. These were voluntary purchases, not incentive-driven compensation.

Ownership across the wider leadership team is meaningful, supported by long tenure and continuity at both executive and board level. Management and directors are therefore economically exposed to the same outcomes as shareholders.

Combined with the decision to abandon third-party fundraising and invest solely from the balance sheet, insider ownership completes the alignment loop. Governance at 3i rewards NAV per share growth, not activity, asset gathering, or short-term exits. In a concentrated structure dominated by one exceptional asset, that alignment is essential.

Action and its moat

Now we shift from 3i to Action. And this is where it gets really interesting. Action is a European discount retailer with a model that looks simple on the surface: small-box stores, fast inventory rotation, extreme value, and relentless operational efficiency.

The reality is more interesting.

Action’s success is not driven by a single advantage, but by two reinforcing moats that compound as the business scales. Together, they create a flywheel that is extremely difficult to replicate.

Moat #1: Scale Economies Shared

Action is a textbook example of Scale Economies Shared.

The company is relentlessly focused on sourcing attractive deals. As the system scales, unit costs fall and operational efficiency rises across procurement, logistics, and store operations. Crucially, Action does not retain all of those gains. A meaningful portion is passed on to customers through lower prices, which drives higher traffic and volumes. That, in turn, increases scale further, unlocking additional cost savings. The loop then repeats.

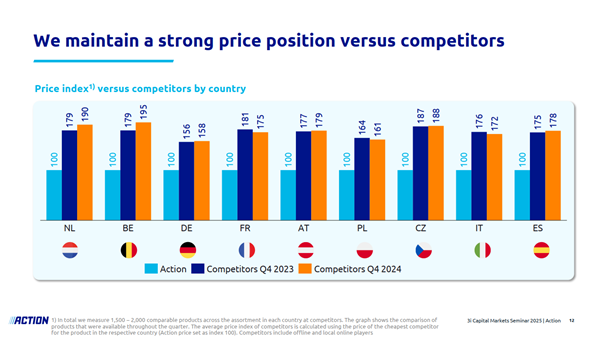

This flywheel has produced a stark outcome: Action’s prices are typically 58-95% lower than competitors on comparable products (per company materials). That is not a marketing claim; it is the economic consequence of scale being deliberately shared rather than fully harvested.

The result is a structurally advantaged price position that competitors struggle to match without destroying their own margins. From the 3i Capital Markets Seminar 2025:

Moat #2: The rotating SKU treasure-hunt model

The second moat sits at the product and customer experience level.

Action operates a tight 6,000-8,000 SKU model at any given time, dramatically lower than most general merchandise retailers. The assortment is highly dynamic:

Roughly 150 new products are introduced every week

Many SKUs rotate out quickly

The store experience feels treasure-hunt-like, encouraging frequent visits and impulse purchases

This model creates several reinforcing advantages:

Ultra-low pricing through concentrated buying power

Tight SKU discipline, reducing complexity and waste

Fast replenishment and high inventory turns

No active marketing spend - the assortment itself drives traffic

About 67% of Action’s products are priced below €2. Customers do not come for a specific branded item; they come because they trust the value proposition.

Competition

Action does not compete in the traditional sense.

On individual products, there is plenty of competition: Let’s take the Netherlands as example. In the Netherlands alone, chains like Zeeman, Wibra, and Gamma overlap on parts of the assortment. Supermarket like Lidl, Aldi overlap on other parts of the assortment. Action competes with categories, not with a single format peer. No retailer offers the same combination of ultra-low prices, rotating assortment, scale-driven economics, and treasure-hunt experience.

This is similar to early Walmart. Walmart was not the first supermarket, but it rewrote the rules by building a system competitors could not economically follow. Action is doing something similar in European non-food discount retail.

There is no true like-for-like competitor to Action today. Not in the Netherlands, and not elsewhere in Europe. That uniqueness matters. It explains why Action has been able to scale rapidly without triggering a destructive pricing response from incumbents.

Today, Action is the fastest-growing non-food discounter in Europe, operating in 14 countries, with Switzerland and Romania added in 2025, and significant runway remaining across both mature and newer markets.

Action Unit Economics

Action’s high-level financials illustrate why it is not a fad-type retailer:

Net sales: €8.9bn (2022) -> €11.3bn (2023) -> €13.8bn (2024)

Operating EBITDA: €1.2bn -> €1.6bn -> €2.1bn (2024)

EBITDA margin: 13.6% -> 14.3% -> 15.1% (2024)

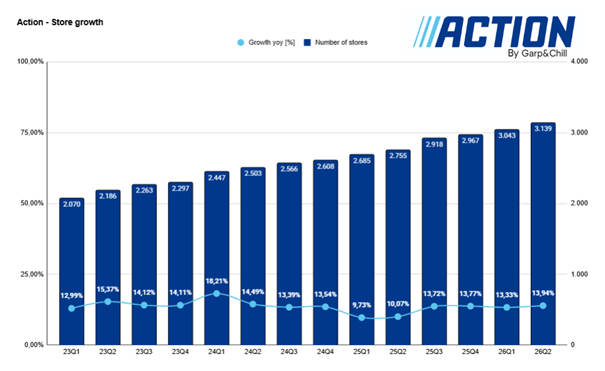

Stores: 2,263 -> 2,566 -> 2,918 (end of 2024)

That combination is rare in retail: strong top-line growth, expanding margins, and rapid unit expansion occurring simultaneously.

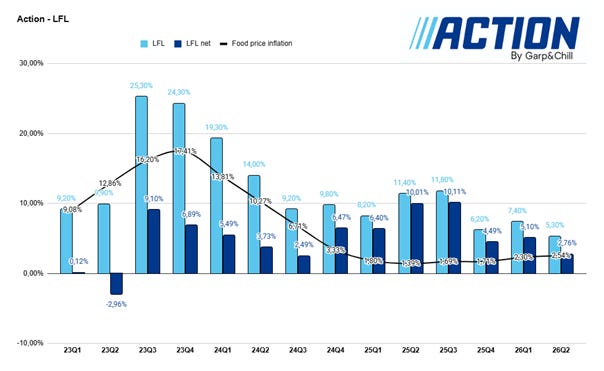

Action’s revenue growth is driven by a powerful two-engine model: continued store expansion and positive like-for-like (LFL) growth.

Even at significant scale, Action continues to grow its store base at roughly 14% year-on-year, reaching more than 3,100 stores today. That level of expansion is exceptional for a retailer of this size and underscores how early the rollout still is across much of Europe.

At the same time, LFL growth remains positive as inflation normalizes. 2023 comparables have cooled into more sustainable levels, but crucially, growth has persisted rather than collapsed. That distinction matters: retailers that merely benefited from an inflation tailwind typically give back growth once conditions normalize. Structural winners keep growing because the value proposition is real.

Recent softness in LFL trends has been most visible in France, now one of Action’s largest markets with roughly 900 stores. Short-term macro factors, including weaker consumer spending and strikes, have weighed slightly on LFL performance. Despite this, total sales and profitability continue to expand, supported by ongoing store openings. Importantly, Action has repeatedly been voted France’s favourite retailer, reinforcing that demand strength is structural rather than cyclical.

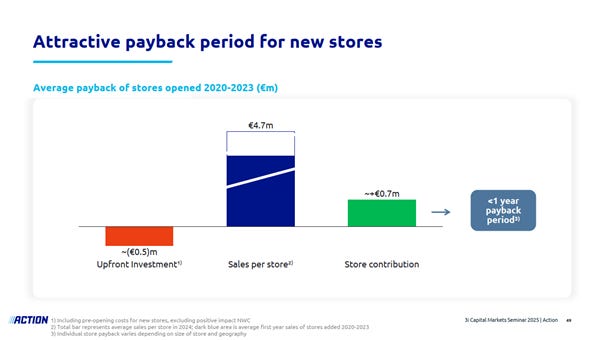

Unit economics: a sub-1-year payback

This is the slide that should make long-term investors pause:

Upfront investment per store: ~€0.5m

Sales per store: ~€4.7m

Store contribution: ~€0.7m

Payback period: less than one year

From the 3i Capital Markets Seminar 2025:

A sub-1-year payback means the store base functions as a self-funding compounding engine, provided that rollout discipline is maintained, unit economics remain intact, and competition does not force structural margin compression. This dynamic explains why Action can continue opening stores aggressively without the model becoming fragile.

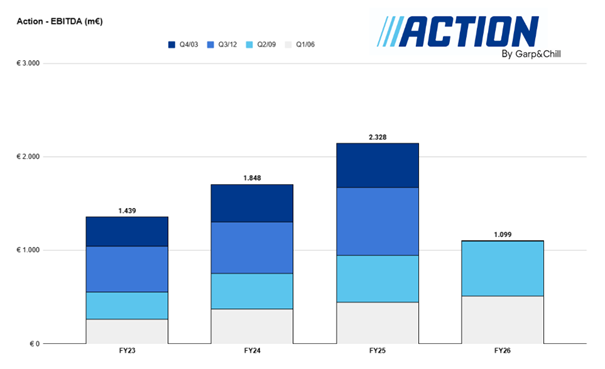

The EBITDA bridge confirms that growth is not limited to revenue:

FY23: €1,439m

FY24: €1,848m

FY25: €2,328m

FY26 (partial period shown): €1,099m

This is exactly what investors want to see: operating earnings compounding alongside expansion, validating that scale is translating into durable profitability rather than temporary growth.

Total Addressable Market

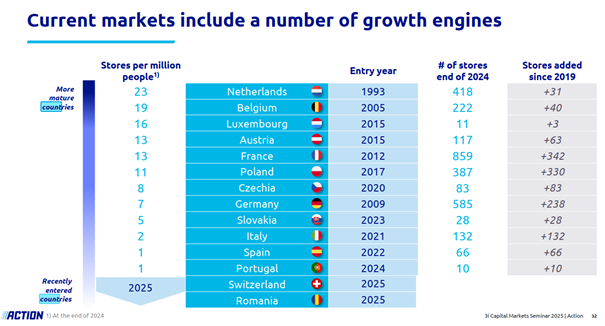

Action is still early in several markets and has only recently entered others, as shown in its Capital Market Seminar 2025 slide.

The breakdown by country highlights entry year and store count at the end of 2024, with large, more mature footprints such as France (859 stores), Germany (585), the Netherlands (418), and Poland (387). At the same time, it shows much newer markets with limited penetration, including Portugal (10 stores), alongside 2025 entries such as Switzerland and Romania.

The key takeaway is that store density varies widely by country. This makes the growth runway tangible and observable rather than a vague claim of “management optimism.” Expansion potential is clearly visible in the numbers.

Importantly, management’s current estimate of additional white space potential across existing and identified in-scope countries now stands at approximately 4,850 stores, representing roughly 500 additional stores versus the potential identified last year. This guidance is intentionally conservative and based only on markets already under consideration.

For context, broader retail benchmarks suggest far larger theoretical ceilings. Lidl operates more than 12,000 supermarkets across Europe, while Dollarama runs roughly one store per 20,000 inhabitants. Applied mechanically to Europe’s ~750 million inhabitants, this would imply a theoretical capacity approaching 40,000 stores.

To be clear, this is not an argument that Action will ever approach that number, nor that current store-level economics would remain unchanged at such scale. The point is simpler: the risk is not running out of runway. Even under conservative assumptions, Action appears to have many years, if not decades, of expansion ahead.

Valuation

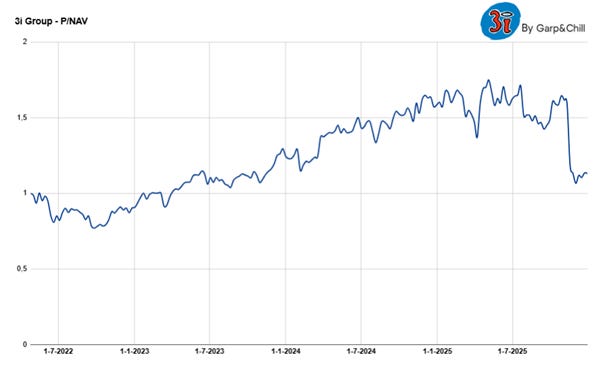

There are two distinct valuation layers to 3i: NAV per share and P/NAV

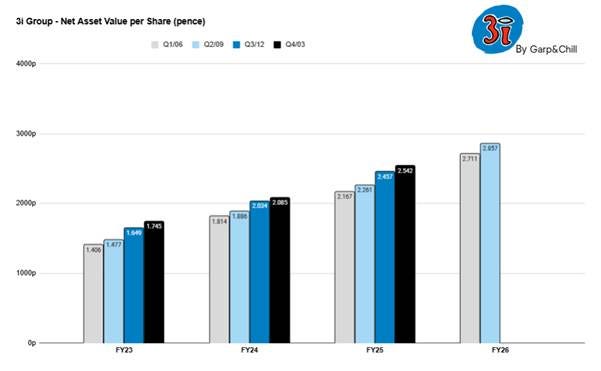

The starting point is NAV per share, which has compounded steadily over time:

FY23 Q2: 1,477p

FY24 Q2: 1,886p

FY25 Q2: 2,261p

FY26 Q2: 2,857p

Since Simon Borrows took the helm in 2011, 3i has compounded NAV at approximately 19.8% per year, excluding dividends. On top of that, the company currently offers a dividend yield of ~2.5%. Given the quality of the underlying assets and the discipline of capital allocation, I see no reason why 3i cannot continue compounding at a rate close to these levels over the long term.

The key, of course, is not overpaying.

Here, 3i has already embedded a margin of safety into its reported NAV by valuing Action at just 18.5x EBITDA. That looks conservative for a retailer with:

· double-digit store growth,

· positive like-for-like sales,

· negative working capital,

· ~15% EBITDA margins,

· decades of runway, and

· a large addressable market.

For context, comparable benchmarks suggest materially higher multiples:

· Costco trades at roughly 30–35x EBITDA,

· Dollarama trades at around 23x EBITDA,

· European discount retail transactions typically clear at 20–25x,

· A reasonable private-market multiple for an asset like Action would likely be closer to ~25x EBITDA.

If Action were publicly listed, it would almost certainly trade above the multiple currently embedded in 3i’s NAV.

Market sentiment toward 3i itself is best captured by the P/NAV multiple. When that multiple compresses meaningfully while NAV continues to grow, history suggests those periods often present attractive long-term entry points, provided the underlying asset economics remain intact.

Then the market’s mood is captured by P/NAV multiple changes.

This leads to a conservative way of framing the investment:

· Assume the non-Action portfolio is fairly valued at carrying value.

· Focus the debate solely on Action.

· If Action is a structural winner with long runway, the remainder of the portfolio functions as either a stabilizer or upside optionality.

Bear Case

A strong bull case deserves a serious bear case. The risks around 3i and Action are not theoretical; they are observable and trackable over time.

1) Like-for-like growth keeps decelerating

Action’s LFL growth has been trending down from exceptionally strong post-inflation levels. If this deceleration continues, sentiment could deteriorate quickly.

Retail multiples are fragile when comp momentum breaks. The market tends to punish even high-quality retailers once LFL momentum stalls.

What to watch:

LFL trend

Whether LFL stabilizes at a “normal” level or continues to roll over

2) Store-level unit economics deteriorate

Action’s sub-one-year payback period is a core moat signal. If this deteriorates meaningfully, something structural has changed.

Potential causes:

Cost inflation

Increased competitive pricing pressure in newer markets

Lower store productivity as the best locations are exhausted

Higher labor or logistics costs in marginal geographies

Why this matters:

Fast payback is what allows Action to self-fund growth, reinvest aggressively, and compound without external capital. A drift toward longer payback periods would reduce reinvestment optionality and compress returns.

3) Execution risk in new geographies, especially the U.S.

Action is eyeing the U.S. market. New market entry always carries higher execution risk. The U.S., in particular, has been a graveyard for European retailers.

Challenges include:

Different labor dynamics and wage structures

More complex logistics over larger distances

A highly competitive discount and dollar-store landscape

Cultural differences in shopping behavior

While U.S. expansion could offer significant upside optionality, the Action playbook may not translate as cleanly. Failure would not break the thesis, but capital misallocation could dilute returns.

4) Minimal online presence

Action’s model is deliberately store-led. With approximately two-thirds of SKUs priced under €2, online economics do not make sense.

However, risks include:

Consumer behavior shifting more aggressively toward online for everyday categories

Competitors using digital channels to complement physical retail more effectively

Missed opportunities in click-and-collect or limited digital engagement

That said, this is a structural trade-off rather than a flaw. The treasure-hunt model is inherently physical, but it does cap optionality.

5) France execution risk (short-term, not structural)

France represents roughly one third of Action’s revenue and has been the main source of recent noise.

Issues include:

Softer LFL trends

Historical logistics and distribution center challenges (previously acknowledged by management)

A sharp market overreaction, with the stock selling off aggressively

Why it matters:

France is large enough that short-term execution issues show up at group level and can dominate sentiment.

6) Geopolitical risk in Europe

Escalation of conflict within or near the EU could:

Disrupt supply chains

Increase energy and logistics costs

Weaken consumer confidence

Pressure discretionary spending

While Action benefits from trade-down dynamics, extreme macro shocks can overwhelm even defensive retail formats.

7) Key-person risk: Simon Borrows

Simon Borrows is central to the 3i story. Since joining in 2011 and becoming CEO in 2012, he transformed the firm from a fundraising-driven PE model into a balance-sheet-led compounding vehicle.

Risks include:

Leadership transition disrupting capital allocation discipline

Cultural drift away from long-term compounding

Reduced conviction in increasing ownership of Action over time

Succession planning matters. While the organization is deep, Borrows’ influence on strategy and alignment is significant.

Bottom line on the bear case

None of these risks invalidate the thesis on their own. But several moving in parallel, especially sustained LFL weakness combined with deteriorating unit economics, would force a reassessment.

The advantage of this setup is that most risks are measurable:

LFL trends

Payback periods

Store productivity

Capital allocation behavior

Insider actions

As long as those remain intact, the thesis remains credible.

Closing

If you strip away the noise, the 3i story is remarkably clean.

3i is increasingly a public wrapper around Europe’s most exceptional retailer.

Action combines two rare qualities: elite unit economics and long runway. Its scale-economies-shared flywheel drives structurally lower prices, higher traffic, and growing purchasing power. Its rotating SKU, treasure-hunt format creates customer loyalty without marketing spend. The result is a retail model that grows stores at double-digit rates, sustains positive like-for-like growth, expands margins, and pays back new stores in under a year. That is not cyclical luck. It is structural advantage.

3i, meanwhile, is the ideal owner. Under Simon Borrows, it transformed from a fundraising-driven private equity platform into a balance-sheet-led compounding vehicle. Incentives are aligned, insider ownership is meaningful, and capital allocation decisions are made with an owner’s mindset. The company continues to increase its stake in Action while valuing it conservatively at ~18.5x EBITDA, embedding a margin of safety directly into NAV.

At today’s price, 3i trades at a P/NAV of ~1.14, despite having compounded NAV per share at nearly 20% annually since 2011, excluding dividends. Periods where sentiment compresses the P/NAV multiple while NAV keeps growing are not a bug of this structure. They are the opportunity.

The cleanest way to frame the investment is also the most conservative:

Treat 3i as Action plus the rest at reported values.

Let Action justify the valuation.

View the remainder of the portfolio as stability and optional upside.

The risks are real, but they are observable. Like-for-like trends, store-level economics, rollout discipline, capital allocation behavior, and insider actions tell you when the thesis is working and when it is not. As long as Action’s unit economics remain intact and 3i continues to allocate rationally, the compounding engine remains on.

I am not arguing that Action will dominate all of retail, nor that growth will be linear. I am arguing something simpler: this is a rare combination of a world-class operating business and a rational, aligned owner, offered through a structure that periodically misprices itself.

That is exactly the kind of setup long-term investors should be looking for.

3i Group – Ready? Action.

Disclosure: I do now own a position in 3i Group at the time of writing, but 3i is high on my watchlist and plan to initiate a position in coming months.

Great write up, definitely added to the watch list.